Living abroad as an American expatriate has its perks, but amid the tumultuous waves of information during the COVID-19 pandemic, many expats might have missed a crucial piece of news — eligibility for U.S. Government Stimulus Checks.

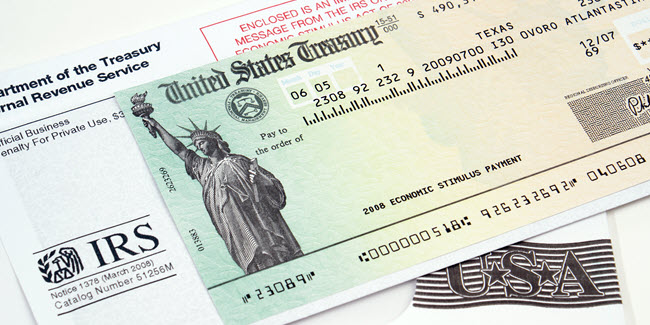

U.S. Government Stimulus Checks: A Guide for Expats on Securing Available Funds (Photo: MyExpatTaxes)

Stimulus Rounds Recap: A Financial Resurgence for Expats

In a recent report published by Go Banking Rates, in December 08, 2023, despite the distance, individual expats could potentially claim thousands of dollars in U.S. government stimulus checks or stimulus payments, spanning three rounds from 2020 to 2021. Understanding the eligibility criteria and deadlines becomes crucial for those who might have overlooked this financial lifeline.

The U.S. government stimulus checks rolled out three rounds of stimulus payments, offering up to $3,400 per individual and $2,500 per eligible child. From the CARES Act in March 2020 to the American Rescue Plan Act in March 2021, each round had distinct criteria and amounts. While eligibility hinged on income and other factors, American expats residing overseas remained qualified.

To seize this opportunity, expats must file both their 2020 and 2021 tax returns, with a deadline extension until June 15, 2025, for the American Rescue Plan claimable on the latter. Navigating these financial opportunities requires timely action and accurate information for expats to secure their deserved U.S. government stimulus checks support.

READ ALSO: A Community Farm In Massachusetts Is Supplying Locally-Grown Food To Those In Need To Combat Food Insecurities

Ensuring a Seamless Claim Process

According to the recent data released by Yahoo Finance, despite the potential financial windfall, expats face a maze of filing deadlines with slight variations. Different sources cite deadlines, emphasizing the importance of staying informed about U.S. government stimulus checks and seeking professional advice. Managing these deadlines becomes crucial, and expats should consider the IRS’s default address system.

Keeping address information updated with the IRS prevents complications, ensuring a smoother process for expats to claim their U.S. government stimulus checks or stimulus payments. As the deadlines approach, expatriates can benefit from proactive strategies, contacting tax professionals with expertise in U.S. expat returns to navigate this financial labyrinth and secure their entitled U.S. government stimulus checks relief.

READ ALSO: Florida Senate Approves $200 Annual Fee For Electric Vehicle Owners