Idaho lawmakers introduce a bill proposing tax credits for private school parents who opt for private school education, enabling families to receive up to $5,000 in tax rebates for school expenses.

Idaho lawmakers introduce a bill proposing tax credits for private school parents who opt for private school education (Photo: AOL)

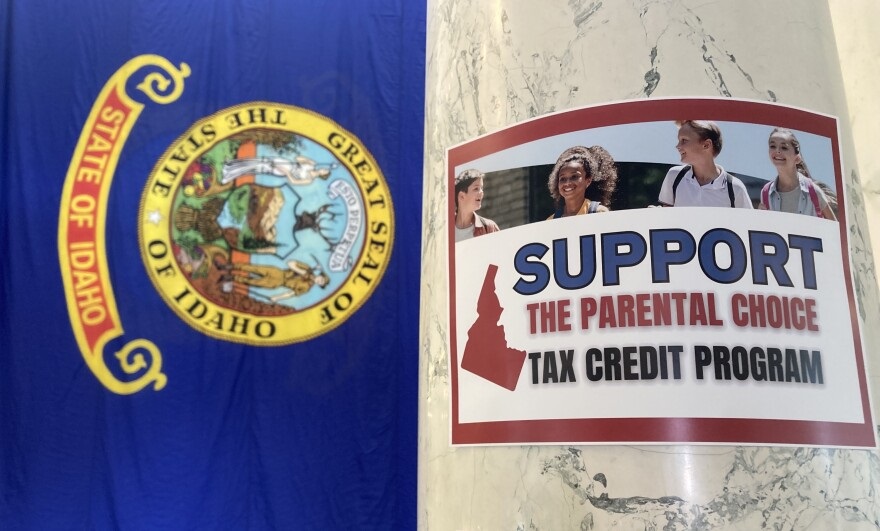

Idaho Lawmakers Crafting a Bill Proposing Tax Credits for Private School Families

In a recent development at the Idaho Capitol, supporters of a bill advocating state funds to send children to private schools gathered, presenting a compelling case for educational choice. The proposed bill, named the Parental Choice Tax Credit and sponsored by Rep. Wendy Horman and Sen. Lori Den Hartog, aims to enable families to claim up to $5,000 in tax rebates for various school expenses, including private school tuition, textbooks, and transportation costs.

With the help of this Tax Credits for Private School, parents of children with special needs could be able to receive for their child’s education with up to $7,500 in support. With the State Tax Commission required to supply the tax credit forms, the program is tailored to the unique requirements of families. The program will use $50 million in state funding in total; $40 million will be made accessible first come, first served, and an extra $10 million will be managed as grants for parents of lower income.

Private schools, predominantly located in urban areas, offer a varying range of tuition costs, with some amounting to tens of thousands of dollars per year. With approximately 41,000 K-12 students not enrolled in public schools, the bill has the potential to channel over $200 million annually toward private education, resulting in a substantial impact on Idaho’s educational landscape.

READ ALSO: Tax Filing Tips For Parents: Maximizing Returns And Benefits Up To $2,000 For Families Using Child Tax Credits

This proposal reflects the increasing popularity of school voucher programs in conservative states, allowing families to access state funds for educational choices. However, Democratic lawmakers have expressed concerns about the potential reduction in funding for public schools, emphasizing the impact on predominantly wealthy and urban Idahoans.

While the bill faces both skepticism and support, it aims to address the diverse educational needs across Idaho, thus requiring careful legislative review and evaluation.

READ ALSO: Reduce Your Tax Bill: The IRS Offers Tax Credits For Energy-Efficient Home Improvements