Social Security is a significant income source for retired individuals, often the biggest one. However, many people are confused about certain aspects of Social Security retirement benefits program, which can result in making mistakes and missing out on opportunities to increase their monthly payment.

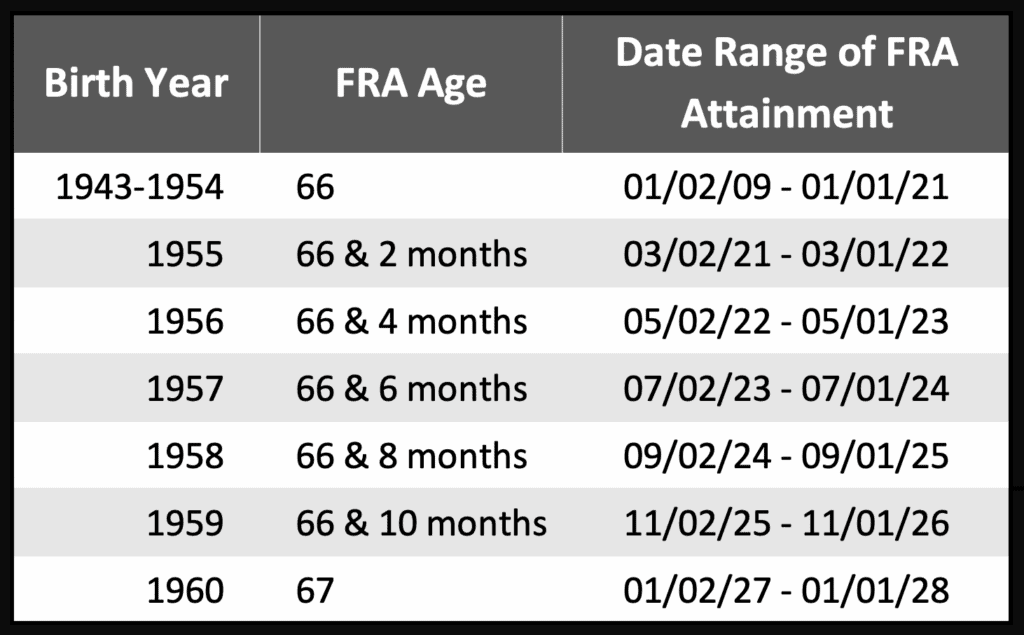

FRA changes based on your birth year. | Social Security Intelligence

It is possible for retired workers to temporarily stop receiving payments, which can result in an increase in their Social Security retirement benefits.

Retired workers who have applied for Social Security retirement benefits can change their minds within one year of approval. To do so, they need to repay all the benefits they received. To cancel or withdraw their application, they must fill out a Form SSA-521.

On the other hand, retired workers who have reached their full retirement age (FRA) have the option to suspend their Social Security retirement benefits until they turn 70. The benefit will then restart automatically at age 70, but retirees also have the choice to resume payments earlier if they prefer.

In either case, workers accumulate their delayed retirement benefits which mean that their Social Security retirement benefit will increase by two-thirds of 1% every month, or 8% annualy, until they start receiving Social Security payments. The only difference is when these retirement benefits start accumulating.

If workers undo their decision to claim Social Security at their full retirement age (FRA), the retirement benefits credits will begin to accumulate at that point. However, if workers have already reached their FRA and decide to suspend their retirement benefits instead, the retirement benefits credits will only start accumulating the month after they make the request.

ALSO READ| Education Loan Burden: Worry No More! Here Are The Essential Tips On How To Reduce It!

The Social Security keeps a record of the years in which you have paid taxes. SSA keeps track of that to know your eligibility for Social Security in retirement benefits

To be eligible for benefits, you must meet the following Social Security Administration criteria:

– 62 years old or older.

– have worked and paid Social Security taxes for 10 years or more.

If you haven’t worked or paid taxes for 10 years, you may still be eligible for a monthly benefit based on the work history of your current or former spouse although requirements may vary.

The Social Security keeps a record of the years in which you have paid taxes.

READ MORE| Are You Beating the Average Social Security Retired Worker’s Benefit for Your Age?